Image 1 of

Image 1 of

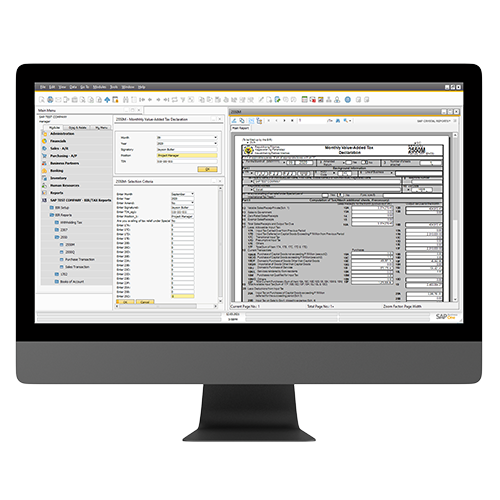

Philippine Tax Module for SAP Business One

Achieve BIR CAS and tax compliance without sacrificing countless hours of reconciling in a single, simple, and integrated system that automates the creation of your tax reports.

Achieve BIR CAS and tax compliance without sacrificing countless hours of reconciling in a single, simple, and integrated system that automates the creation of your tax reports.

Achieve BIR CAS and tax compliance without sacrificing countless hours of reconciling in a single, simple, and integrated system that automates the creation of your tax reports.

What is Philippine Tax Module?

The Philippine Tax Module is a standard corporate taxation program integrated with SAP Business One, exclusively developed and customized by Xceler8 Technologies, Inc. It is designed to automatically generate the BIR required forms, reports and .dat file making it easier and more efficient for the users. It automates and expedite generation of monthly, quarterly and yearly VAT and Withholding tax reports and forms for payments and compliances.

Sample of forms 1702Q and 2307Q

The Philippine Tax Module The Philippine Tax Module includes the following forms and reports:

Sample of form 2550M

• Withholding Tax

• 0619E • 1604E

• 0619F • MAP (Expanded)

• 1601EQ • MAP (Final)

• 1601FQ

• Expanded Withholding Tax (EWT)

• 2307 by Quarter

• 2307 by Document

• VAT Returns

• 2550M • Purchase Transactions

• 2550Q • Sales Transactions

• 1702Q

• Book of Accounts

• General Ledger • Sales Journal

• General Journal • Purchase Journal

• Cash Receipt Journal • Inventory Journal

• Cash Disbursement Journal

Sample of form 2550Q